Worldwide economies have come to a grinding halt ever since the novel coronavirus pandemic broke out resulting in a steep fall in both production and demand. However, India does have the potential to make a steady comeback by providing impetus to its startup ecosystem that will further create more valuable Unicorns. India holds the ability to build more than 200 Unicorns among half a million start-ups up over the next 3-4 years, up from the existing 50,000. Despite our capacity, we have only produced 36 Unicorns till today which countries like China and the USA lead the Unicorn race.

This can be due to the lack of accelerators in our country such as the Y Combinator and 500 Start-ups, which help companies with financing and potentially turning them into Unicorns at the stage when it’s all just an idea. According to a report, Indian startups received $14.5 billion worth of funding which is 9.3 times less than startups in the USA.

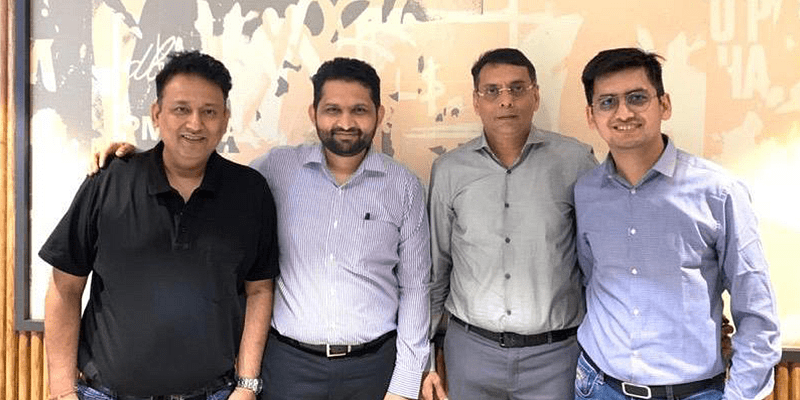

Recognizing the roadblock the Indian startups face, Dr. Apoorva Ranjan Sharma, Anuj Golecha, Anil Jain and Gaurav Jain, founders of India’s first and the most massive integrated incubator, Venture Catalysts (VCats) have launched an accelerator VC called ‘9Unicorns Accelerator Fund’ (9Unicorns) functioning on the same lines as the USA-based Y Combinator, but for Indian startups only.

9Unicorns has been launched during the COVID-19 pandemic with the idea that it will help create many unicorns in this time of crisis. “Recession is the best time that can be utilised to create a startup economy. It is only possible if we have a strong accelerator network that we lack currently and precisely the reason why we have launched 9Unicorns. The aim is to help startups keep up with the growing sizes of idea-stage financing and create more global Unicorns from the country,” said Dr. Sharma.

The 9Unicorns Business Model

9Unicorns is a $45 million sector-agnostic accelerator VC fund intending to offer $100k for 5-7% equity per startup. These startups would then be eligible for a follow-on round of $500k to $2 million that would be funded by syndication of VCats Network and global VC funds. Plus, they would receive 3 months of the accelerator and 18 months of post-incubation support. 9Unicorns plans to write the first cheques worth $100,000 for early-stage startups after thorough rounds of curation and elimination.

“The idea behind 9Unicorns was to create a platform to help innovative start-ups by providing initial hand-holding with funds and proper mentorship so that they can thrive and graduate to the next level with a proper go-to-market strategy,” said Anuj Golecha while Gaurav Jain added “At 9Unicorns, we will be backing driven and execution-oriented entrepreneurs by removing roadblocks for entrepreneurs. The overarching idea is minimal interference and maximum support. 9Unicorns invests in very early stages, and traction for such startups is like oxygen. Access to fast capital, business, and talent networks go a long way in helping founders focus on product & customers.”

VCats has incubated over 90 startups since its inception, helping them raise more than $168 million. VCats have been an early investor in startups such as Innov8, Beardo, PeeSafe, and BharatPe amongst others. VCats has developed to become a platform that invests in four deals a month in the range of $500K – $2 million per transaction. 9Unicorns is expected to further these milestones achieved by VCats. 9Unicorns is focusing on a hand-on support ecosystem for startups which goes beyond the ability to provide capital. Startups will get access to a global network of successful founders across domains, CXOs of large corporations, seasoned angel investors, and partners of global VC funds.

Anil Jain concludes with “The idea of 9Unicorns is to create a portfolio of 100 startups in the next 30-36 months and help create more unicorns out of its stable. Plus we plan to bring in the concept of Rolling Admissions and implement a conveyor-belt approach.”