India has become the biggest market worldwide for investors, with so many new avenues to explore and a consumer base of 1.3 billion. It is untapped and full of learning opportunities for new investors and investment giants. With such raw potential also come great risks because tried and tested ideas may or may not work here. Investing in India is not easy given its different political and economical climate as compared to the rest of the globe.

A good business pitch should not be the only criteria for investment. A company should be structurally sound meaning that the business should have a contingency plan for disasters like the current coronavirus pandemic. An important yet much neglected part is doing a complete background check on the company before investing in India to make sure the business is following all necessary regulations and is legal compliant with the government. It has become easier to have complete company information at your finger tips with The Company Check.

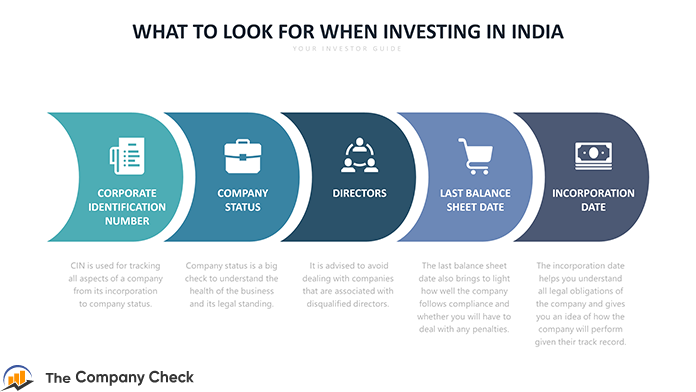

Here are the key elements that one should check before investing in India

CIN

Corporate Identification Number is a unique identification number assigned to the company whether it is a Public or Private company. It is used for tracking all aspects of a company from its incorporation to company status. CIN is a 21 digit alpha-numeric code issued to the stock market. The first character of CIN reveals whether a company is listed or unlisted in India.

Company Status

When a company is incorporated it is given an Active status. Status refers to the current position of the business whether it is active, closed, liquidated, strike off, etc. Although, apart from this, the company can be at any of 14 unique statuses. Company status is a big check to understand the health of the business and its legal standing. This can help investors avoid problems with the Indian government.

Incorporation Date

Generally, the incorporation date determines when the company has been registered as per the Companies Act, 2013 with the Registrar of Companies, under the Ministry of Corporate Affairs. The company incorporation date helps you understand all legal obligations of the company and gives you an easier idea of how the company will perform given their track record so far.

Last Balance Sheet Date

When you review the details of the company, the last balance sheet date shows the latest financial year for which the company has submitted their annual return to the MCA. Any company fails to file their annual returns for more than 3 financial years shall be considered as defaulting company by Ministry of Corporate Affairs (MCA). The last balance sheet date also brings to light how well the company follows compliance and whether you will have to deal with any penalties.

Registered Address

The registered address is the address at which the company is incorporated. The registered address of the company can be checked in the Incorporation Certificate. Although, the registered office address can be changed from the corporate office or head office address of any company. A company may change the registered office address and the same can be verified using the respective MCA forms such as INC-22, MGT-14, etc. It is necessary to make sure you are aware of the registered address of the company you wish to invest in as rules regarding companies may vary from state to state.

Directors

It goes without saying that you should do a complete background check on who you work with. The MCA has disqualified over 3 lakhs directors due non-compliance in the filing of company annual returns under section 164 (2)(A) as well as for not submitting Director KYC. It is advised to avoid dealing with companies that are associated with disqualified directors. You can check up on entire director profiles and directorships using our Director Search feature.

For company master data, visit us at The Company Check and get everything on a company including financials, charges, legal cases, contact details and more before you invest in any private limited company in India.