The term “insurance” was coined with the goal of reducing risk and providing protection. The most common method of reducing life risk is to get insurance. There are various types of insurance policies available today to protect your loved ones and the things you love When it comes to choosing the right insurance plan, you are spoilt with choices as there are various insurance players in the market offering.

Let’s look at how and why the insurance industry is so important in the growth of any economy.

- Provides Safety and Security to Individuals and Businesses

- Generates Long-term Financial Resources

- Promotes Economic Growth

- Provides Support to Families during Medical Emergencies

- Spreads Risk

Read About: Unicorns emerging during this pandemic

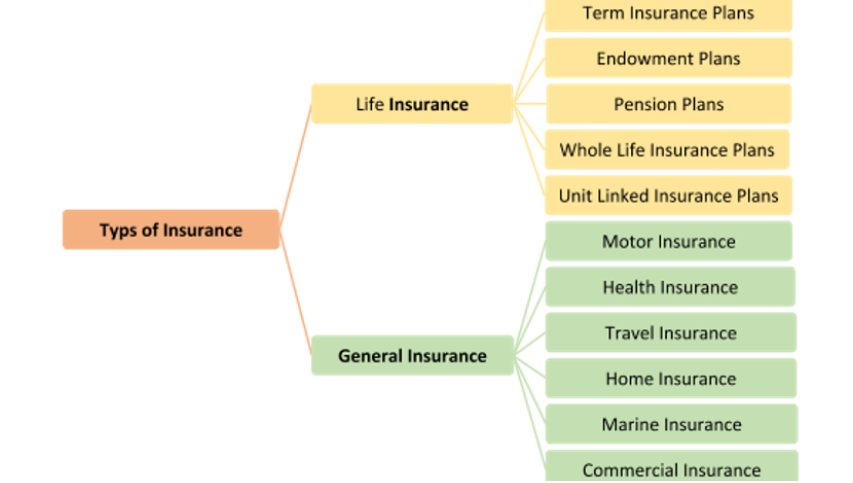

There are several insurance plans available, each of which is designed to protect certain parts of your health or possessions.

The Oriental Life Insurance Company, founded in Kolkata in 1818, was the first life insurance company to be established in India. Many businesses began operating in India after then. The Insurance Act was enacted by the Indian government in 1938, with the primary goal of protecting policyholders’ interests.

Also Read: Recent Mergers And Acquisitions – May 2021

Before selling insurance goods, one must first get an insurance firm license from the state’s insurance commissioner. The establishment of the Insurance Regulatory Development Authority of India (IRDAI) has resulted in considerable changes in the insurance industry as a whole.

The Insurance Regulatory Development Authority of India (Registration of Indian Insurance Companies) (Seventh Amendment) Regulation, 2016 governs the registration of insurance companies and the issue of insurance company licenses.

Furthermore, the IRDAI is in charge of issuing licenses for other types of insurance enterprises, such as life, fire, and marine insurance. When selling insurance on an interstate basis, a license is necessary for each state where the business is conducted.

According to 2020 research, India has 57 insurance firms, 24 of which are in the life insurance industry and the remaining 33 are in the insurance sector other than life insurance.

Read Here: Impact of Covid 19 on EdTech industry

Top 6 life insurance companies in India

Bharti AXA Life Insurance Company

In the year 2006, Bharti AXA Life Insurance was formed. AXA Group and Bharti Enterprises have partnered to form this company. These firms’ excellent financial knowledge and domestic business competence have provided the corporation with a solid foundation. Bharti AXA Life has launched a number of new insurance solutions to meet clients’ specific needs. The distribution network of Bharti AXA Life spans 123 cities across India. The firm has a customer base of over ten million people. The organization offers a variety of policies, ranging from protection to savings, health, and group insurance, with the majority of them available on an online platform.

Kotak Life Insurance Company

With over 20 million customers, Kotak Life Insurance Company is one of India’s fastest-growing and top insurance businesses. Kotak Life Insurance’s parent business is Kotak Mahindra Bank. Kotak Life Insurance Company provides a comprehensive selection of insurance products with unique benefits to people from all walks of life. The firm now offers 32+ products, 18 riders, ten Unit Linked Investment Plans, and nine group products. The total value of the company’s assets under management is INR 25,936 crore. The Kotak Group has reached several milestones in the financial services industry and has been regularly recognized and acknowledged for its accomplishments.

Max Life Insurance Company

The Max Life Insurance Firm, which was established in the year 2000, is India’s largest non-bank private sector insurance company. Max Life Insurance Company is a joint venture between Mitsui Sumitomo Insurance Company, a Japanese insurance company, and Indian Max India Ltd, a multi-business Indian corporation Max Life’s wealth under management has already surpassed INR 50,000 crores, making it one of India’s fastest-growing insurance businesses. Max Life has a customer base of over 30 lakhs. Max Life Insurance Company delivers high-quality customer service with a robust web presence, a diverse product range, a multi-distribution channel, and 1090 offices around the country. Max Life has continuously received honors and accolades. Max Life was named ‘Claims Service Leader’ and ‘Excellence in Claims Service’ by CMO Asia Awards for their high claim settlement ratio.

Tata AIA Life Insurance Company

Tata AIA Life Insurance Company is a partnership between Tata Sons Private Limited, one of India’s major commercial conglomerates, and AIA Group Limited, Asia’s largest insurance conglomerate. In 2019, the asset under the management of Tata AIA Life Insurance Company is INR 28,430 crores. Tata AIA Life, being one of India’s most reputable insurance companies, provides a wide range of insurance products, from protection to wealth building. The plans combine exceptional customer service with straightforward solutions for specific insurance requirements.

Birla Sun Life Insurance Company

Aditya Birla is a businessman and philanthropist Aditya Birla Capital Limited owns Sun Life Insurance Company, which was created in the year 2000. The Aditya Birla Sun Life Insurance Company was founded by the merger of the Aditya Birla Group and Sun Life Financial, Canada’s premier international financial services company. The company’s total assets under control are INR 4, 10,110 million. With 425 locations, 9 bancassurance partners, 6 distribution channels, and 85,000+ direct selling agents, the firm is well-represented across the nation. For its sustained contributions to the industry, Birla Sun Life Insurance Company has garnered several honors and honors.

ICICI Prudential Life Insurance Company

The ICICI Prudential Life Insurance Company of India is a joint venture between ICICI Bank Limited and Prudential Plus. As India’s first private sector life insurance business, the firm commenced operations in December 2000. For more than a decade, the firm has held the top spot among private life insurers in the country. ICICI’s mission is to meet the needs of customers at all stages of their lives. ICICI Prudential Life Insurance provides products such as term insurance, pension insurance, child insurance, and investment insurance.

For more information regarding companies visit The Company Check