May witnessed several recent mergers and acquisitions, which raised expectations for the months ahead. Let’s start with a basic understanding of mergers and acquisitions.

Mergers And Acquisitions:

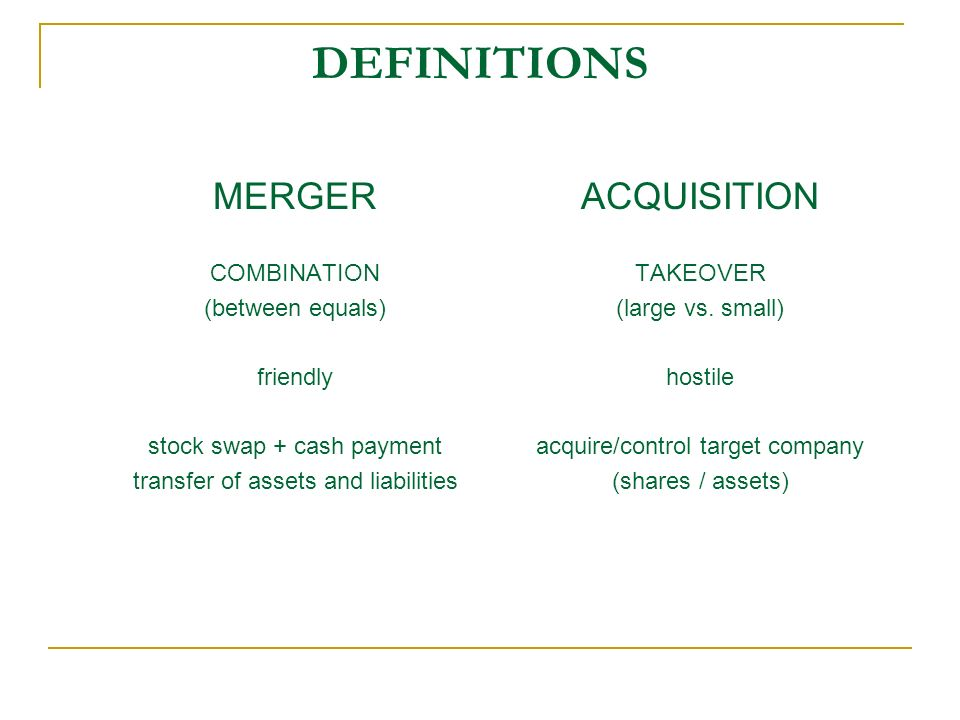

Mergers and acquisitions are two methods for merging two firms into one. The goal of integrating two or more businesses is to achieve synergy. A merger occurs when two firms come together to form a partnership on mutually agreed-upon conditions.

An acquisition occurs when one firm buys another and integrates it into its operations by buying all or most of the other company’s assets.

Read Here: Top 10 Fintech Companies in India

List of merger and acquisition in May

Also read about: Top Unicorn Start-ups in India-2021

Tata Digital acquired with online grocery delivery startup — Bigbasket

The online e-grocery platform is available in over 25 cities and has one of the largest inventories, with over 50,000 stock holding units (SKUs). In addition, the Bengaluru-based business has partnered with over 12,000 farmers and delivers items directly from them.

Tata Digital has positioned itself in direct rivalry with big conglomerates in growing its online grocery delivery footprint, including Reliance Industries’ Jio Mart, e-commerce giant Amazon Inc., and Walmart-owned Flipkart, with this deal.

Bigbasket Founded in December 2011 with its registered office in Bangalore

The online grocery company Tata Digital, located in Bengaluru, was started in 2011 and now operates in 25 cities.

Aknamed acquired with Vardhman Health Specialties

Through the use of technology, data, high-quality infrastructure, and scale, the united teams of Aknamed and Vardhman like to develop a viable hospital-focused supply chain in India, giving value to hospitals, OEM partners, and workers.

VHS, located in Chennai, had revenue of Rs 500 crore in FY21 and expects to double it to over Rs 1,000 crore in the following three years, with the adult immunization segment accounting for a major 30% of that.

Vardhman Health Specialties Founded in the year 1997 in New Delhi.

Aknamed Founded in December 2018 with its registered office in Bangalore, Karnataka

Adani Green Energy Ltd Inked share purchase agreements with SoftBank Group (SBG)

On Wednesday, Adani Green Energy Ltd (AGEL) announced that it has signed share purchase agreements with SoftBank Group (SBG) and Bharti Group for the purchase of a 100 percent stake in SB Energy India for $ 3.5 billion (approximately Rs 25,500 crore).

SB Energy India has a total renewable portfolio of 4,954 MW distributed across four Indian states, according to the announcement. The deal values SB Energy India at about $ 3.5 billion, according to the release.

Softbank is founded in the year 1981 with its office registered in Tokyo, Japan.

Adani Green Energy Ltd is founded in the year 2015 with its office registered in Ahmedabad, India

The merging of Gojek with Tokopedia is likely to result in an initial public offering (IPO).

Gojek, a ride-hailing and payments company, will merge with Tokopedia, an eCommerce company. The merger is likely to enhance both companies’ profits and help Gojek achieve its goal of becoming an all-in-one app.

The deal, estimated to be worth over $18 billion by sources quoted by Reuters, is Indonesia’s largest to date, and it is likely to bring the merged business, GoTo, closer to an initial public offering.

Tokopedia is founded in the year 2009 and its office registered in Jakarta, Indonesia

Gojek is founded in the year 2010 and its office is registered in Jakarta, Indonesia.

KFintech acquires with insurtech startup Artivatic.ai

KFin Technologies, a General Atlantic-backed registration and transfer agency that provides investor services, has announced that it has purchased a 17 percent investment in insurtech firm Artivatic.ai for an unknown price.

This cooperation will help KFintech’s entry into the insurtech industry, as the company seeks to broaden its offerings beyond Mutual Funds, Corporate, and Pensions, among other asset classes. With the help of KFintech, Artivatic.ai will use the funds to develop its product line, explore new commercial vistas, and grow its reach throughout India and other worldwide markets.

Insurtech startup Artivatic.ai was founded in the year 2017 with its registered office in Bangalore.

KFintech was founded in the year 2017 with its registered office in Hyderabad.

Groww to buy Indiabulls AMC’s mutual funds business for Rs 175Cr

Groww, a Bengaluru-based online investment platform, announced on Tuesday that it will purchase Indiabulls AMC’s mutual funds business from Indiabulls Housing Finance for Rs 175 crore in cash and cash equivalents, a move that will help the Bengaluru-based startup break into the asset management space.

With over 1.5 crore users using Groww’s platform to invest in a variety of financial instruments such as stocks, exchange-traded funds, and mutual funds, the acquisition of Indiabulls AMC’s mutual funds business will help the startup strengthen its presence in the online investing space, as well as allow it to cater to a wide range of investors — from retail to high-net-worth individuals.

Indiabulls founded in the year 2020 with it headquarter in Gurugram, Haryana

Groww founded in the year 2016 with it headquarter in Bangalore.

Sitics acquired with logistics startup Quifers

Sitics Logistic, a third-party logistics (3PL) firm, announced on Monday that it has acquired a controlling share in Quifers, a tech-enabled logistics startup, to capitalize on possibilities in the supply chain boom and boost combined revenue by up to 20%.

The deal’s value, however, was not disclosed by the corporation.

With its global footprint, Sitics plans to bring the Quifers platform to Singapore, Malaysia, the UAE, Thailand, Australia, and the EU.

Quifers founded in the year 2015 with its registered office in Mumbai, Maharashtra.

Sitics founded in the year 2007 with its registered office in Palakkad, Kerela.

FuelBuddy acquires fuel delivery startup MyPetrolPump

FuelBuddy, an app-based, IoT-enabled, and cloud-enabled gasoline delivery platform, revealed on Sunday that it had acquired MyPetrolPump, a Bengaluru-based on-demand gasoline delivery business, which would provide it access to additional areas and clients.

FuelBuddy will now have over 100 bowsers (refuellers) under its management, covering 30 locations and all market sectors with a total delivery volume of approximately 40 million liters and approximately 100,000 completed orders.

According to the statement, it focuses primarily on the bulk market and gives FuelBuddy access to expanded regions, consumers, and management bandwidth.

MyPetrolPump was founded in the year 2016 with its registered office in Bangalore.

FuelBuddy was founded in the year 2016 with its registered office in New Delhi.

For more information visit The Company Check